2021 Brings Positive Impact to Rural Colorado Entrepreneurial Ecosystem

2021 Brings Positive Impact to Rural Colorado Entrepreneurial Ecosystem

Highlights include growth and increased support for under-represented entrepreneurs

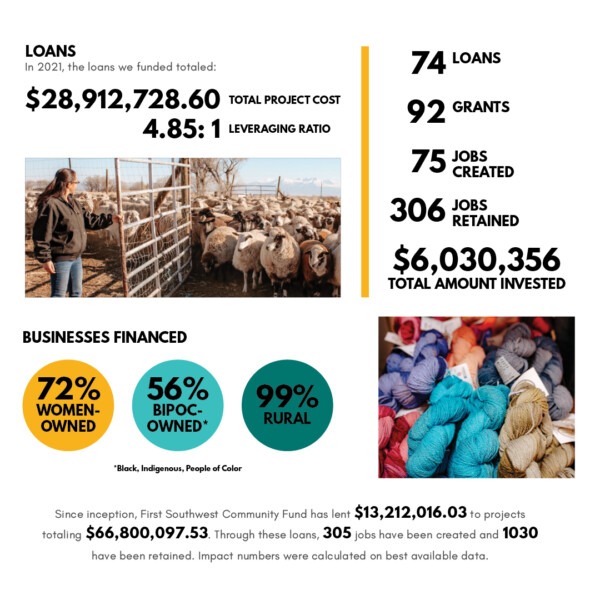

The First Southwest Community Fund (FSWCF), in collaboration with First SouthWest Bank, has released their 2021 impact report which reflects the success of their efforts to reach and assist more under-represented entrepreneurs, small business owners and non-profits. Last year, the organization invested over $6 million into small businesses across rural Colorado, 72% of which were women-owned (up 10% from 2020) and 56% of which were BIPOC (Black, Indigenous, People of Color)-owned (up nearly 20% from 2020).

“We have doubled down on our mission to support under-represented entrepreneurs, focusing on scaling our existing programs like the Rural Women-Led Business Fund, and launching new programs such as the Fortaleza Fund,” explained Cass Walker, Executive Director of the First Southwest Community Fund.

The annual report also includes data on First SouthWest Bank’s impact through the Paycheck Protection Program. The Community Development Financial Institution (CDFI) was able to work with a technology platform to quickly automate their PPP process. This allowed First SouthWest Bank to address the needs of businesses across the state, more than half of which were not previously customers. They ultimately awarded over 1,500 PPP loans totaling close to $100 million, helping to retain 11,896 jobs across 130 Colorado towns & cities.

“Collectively, the two entities have created numerous entirely original and attainable financial lending opportunities, grants, technical assistance and educational opportunities for so many incredible, well-deserving entrepreneurs and small businesses,” said Kent Curtis, Board President of First Southwest Community Fund and CEO & President of First SouthWest Bank.