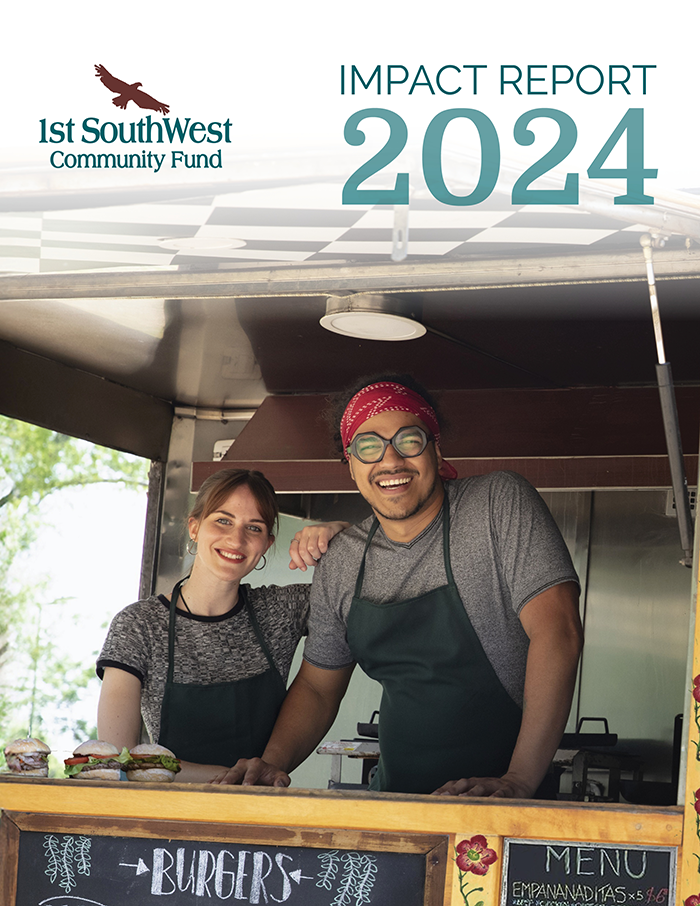

First Southwest Community Fund (FSWCF) and First Southwest Bank (FSWB) have a unique partnership enabling us to provide capital and support for businesses in rural Colorado.

First Southwest Bank’s impact as a Community Development Financial Institution (CDFI) bank, combined with First Southwest Community Fund’s 501c3 status enables us to provide a range of innovative programs and services to small businesses, ensuring everyone can access the capital they need to grow and serve their communities.